- It’s rare for top asset management firms to share their take on bitcoin outside of client notes and meetings.

- We asked four legacy and investing heavyweights to answer five burning investor questions on the asset as the price skyrockets.

- All four firms – Rathbones, Fidelity Digital Assets, Mirabaud Securities and Barclays Private Bank – have seen a surge in client questions on bitcoin.

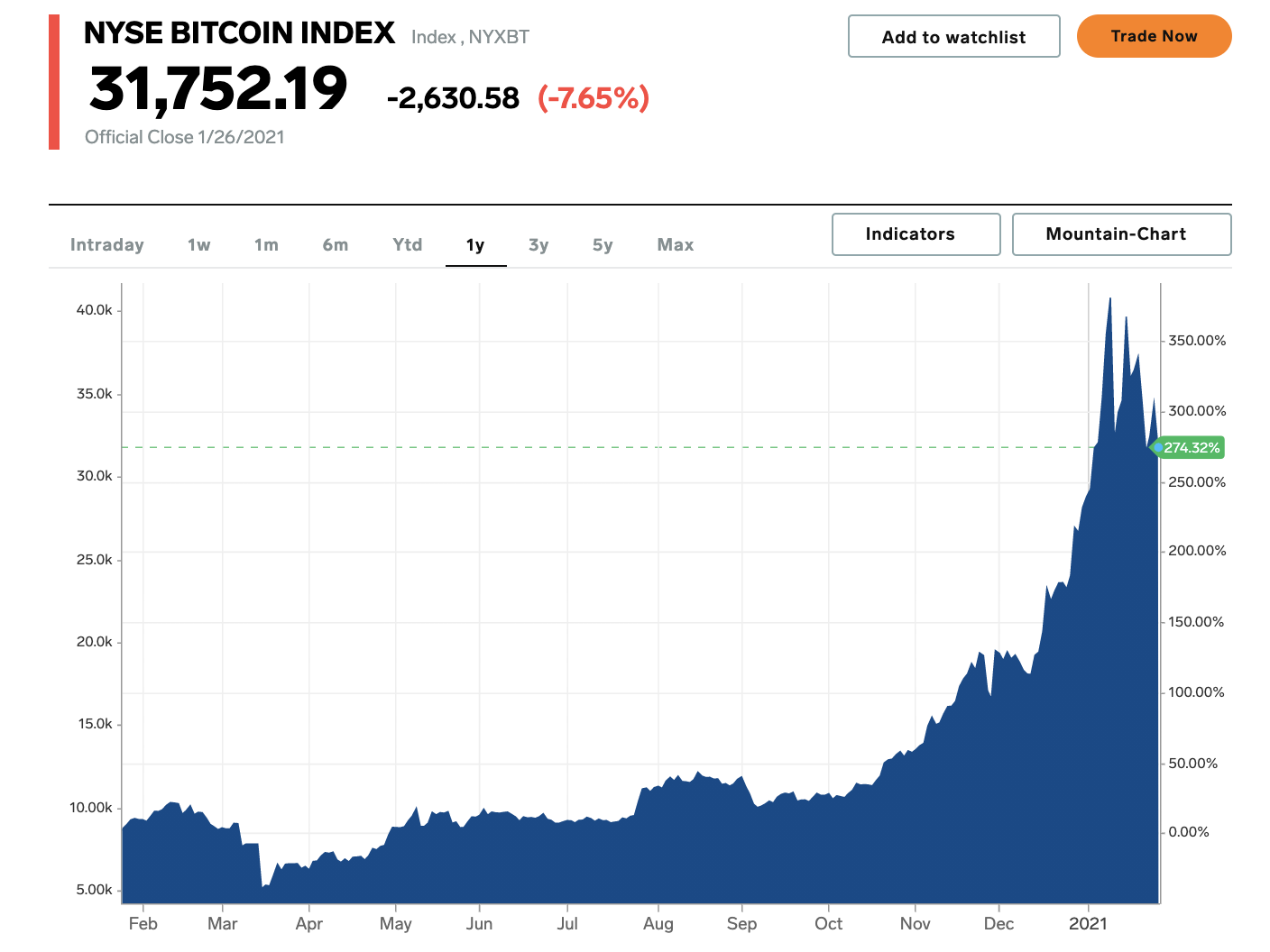

When bitcoin’s price jumped to $22,500 in the middle of December last year, the cryptocurrency started to hit the headlines again and investors started asking whether they should be invested in bitcoin.

Put that question into Google and a range of opinions can be found from early adopters, retail investors and crypto skeptics. However, perspectives from top investment firms are harder to find, especially if investors aren’t clients.

So at Insider, we asked strategists and researchers at four major asset management firms to answer some of the most burning questions on bitcoin that investors are asking as the cryptocurrency’s price skyrockets.

Rathbones, Fidelity Digital Assets (owned by Fidelity Investments), Barclays Private Bank and Mirabaud Securities, have experienced a surge in bitcoin-related client questions.

"We've seen a huge rise in questions from clients and it really started to pick up from December," Edward Smith, head of asset allocation at Rathbones, said.

When bitcoin hit $40,000 in early January, that's when client questions started to really come in, Barclays Private Bank's chief market strategist Gerald Moser said.

"I think it's very natural. If you're in the business of investing, you're following the market every day and you just think, 'Am I missing something?'" he said.

In 2018, Fidelity Investments, which oversees $8.8 trillion in assets, launched Fidelity Digital Assets to provide custody and trade execution services for digital assets to institutional investors.

The firm has seen interest in bitcoin pick up in recent years, but this accelerated when the pandemic began, Ria Bhutoria, director of research for Fidelity Digital Assets, said in an emailed response.

Insider breaks down what these investing experts had to say on five key topics:

"Is bitcoin digital gold?"

The team at UK asset manager Rathbones have analyzed 11 years of available data on bitcoin. They placed it in a variety of portfolios, such as the traditional 60/40 holding, and found it did not function as a diversifier.

"It's a leap of faith to assume that it will be a store of value," Smith said.

Bitcoin doesn't demonstrate safe-haven traits and tends to correlate with equity markets, Smith said. It also tend not to move in lockstep with inflation and has a statistically significant negative relation to gold, he added.

"Bitcoin is so volatile, and because it hasn't had a significant negative correlation with equities, it just increases the total risk of your portfolios, so it's not a diversifier," Smith said.

Moser also looked at this subject in a January 19 research note titled, "Cryptocurrencies: the new gold?"

"Looking at weekly return correlations since 2016 shows that bitcoin is not strongly correlated with any assets (see below)," said Moser, in the note. "It is however only second to the US high-yield in its correlation with equities. US Treasuries, gold and US investment-grade were better di versifiers than bitcoin when it comes to equities."

Bitcoin does have some similar qualities to gold, in that there is a finite supply, it's not backed by any sovereign nation and no single entity controls its production.

But for bitcoin to be considered for a portfolio, it needs to improve the risk/return profile, Moser said.

Bitcoin performed worse than equities over the last three corrections, Moser said, compounding the loss that investors would have incurred from their exposure to stocks.

"Where does bitcoin fit in a portfolio?"

Moser looked at bitcoin from the perspective of an investor and tried to determine if it would diversify a portfolio.

Ultimately he found bitcoin seemed almost "uninvestable"' because of its volatility.

"In summary, difficulty to forecast return, lack of diversification and high volatility makes it hard to consider bitcoin as a standalone asset in a diversified portfolio for long-term investors," Moser said.

Moser, in an interview, suggested investors could think of bitcoin as a form of venture capital investment. There could be some specific cases where bitcoin could do really well in the future, he said, such as a global crisis in confidence in central banks and governments. And other cases where it could falter and go to zero.

Its huge volatility means Rathbone's Smith would caution against bitcoin, especially as he believes it currently has limited fundamentals.

To avoid these extreme price swings, John Plassard of Mirabaud Securities instead recommends investors look toward public firms leveraging blockchain technology, such as Intel, Mastercard, IBM and Amazon, rather than at digital currencies themselves.

"What should investors make of recent rallies?"

The volatility is due to bitcoin's lack of established history, but as more related products become available, it will stabilize, thereby increasing market depth and breadth, Fidelity's Bhutoria said.

She reminds investors that bitcoin is a fixed-supply asset, so unless new bitcoins are mined, the only variable that can change in response to demand is price.

But until the volatility subsides, Moser doesn't see how institutional investors who hold for the long-term will get involved in the market, such as pension or mutual funds.

"The fact that cryptocurrencies also fluctuate alongside equities suggests that investment in bitcoin is more akin to a bubble phenomenon rather than a rational, long-term investment decision," Moser said in a note. " The performance of the cryptocurrency has been mostly driven by retail investors joining a seemingly unsustainable rally rather than institutional money investing on a long-term basis."

"What does payment adoption and regulation mean for bitcoin?"

Many bitcoin bulls cite PayPal's adoption of bitcoin for payments and institutional interest as examples of cryptocurrencies entering the mainstream.

However, several central banks are also developing and trialing their own digital currencies, such as Sweden and China, as well as several private companies entering the market with stable coins - which are tied to a traditional fiat currency - and all of which could compete with bitcoin.

"At launch, approximately 150 million people will be able to buy, sell and spend cryptocurrency in the familiar environment of their PayPal wallet," Plassard said. "The arrival of PayPal in this sector should also push institutions to get more involved. It will still take some time. There are currently too many questions about its end use and the risks of hacking."

Regulation will be the biggest threat to bitcoin and PayPal will could be subjected to it, Smith said.

"I don't think policymakers are going to permit [paying with bitcoin] but they will permit things like stable coins," Smith said.

Smith could see regulators favoring a stable asset, which is pegged to the dollar, a basket of currencies or governments bonds, or state-owned digital currencies, which leverage the blockchain and significantly reduce global transaction costs.

The rise of digital currencies and further regulation will be beneficial for digital assets on the whole, Bhutoria said, not specifically addressing the potential impact on bitcoin.

"What are the ESG implications?"

Regulation isn't the only headwind facing bitcoin. There are environmental, governmental and social factors too.

The digiconomist has a bitcoin energy consumption index, which suggests bitcoin is responsible for 78 Terawatt hours of energy consumption a year, comparable to the entire power consumption of Chile.

The average carbon footprint for a single transaction is 318.89 kg of CO2, whereas the average carbon footprint of a Visa transaction is 0.4g of CO2.

Bitcoin mining could present one of the biggest threats to institutional adoption, as fund managers try to meet their own ESG goals, but also monitor those of the investments in their portfolios, said Smith, who works for Rathbones, an asset manager that has been at the forefront of green investing.

"Bitcoin is incredibly energy intensive, it's incredibly carbon polluting," Smith said. "How does that fit into investors' portfolios in an evermore ESG-mindful world?"

Fidelity's Bhutoria said bitcoin mining consumes a lot of power, but a large portion of it is driven by renewable energy that would otherwise be wasted. For many investors, however, the question is: is it worth it?

"We believe bitcoin holders that derive value from storing value, or transacting in bitcoin would suggest that it is," Bhutoria said.